Private Reserve Strategy

Now, imagine a pile of cash from items you will purchase or finance in the future. Is that future pile a smaller or larger pile than the past pile?

Finally, imagine that most of that future pile is now yours because you used Private Reserve Strategy. Could that make a significant difference to you?

Private Reserve Strategy (PRS) is a process that begins by creating an increasing pool of money. The pool is then leveraged through collateralization for personal spending, investment or business opportunities. It is then repaid, at interest. Over time, this process proves to be an efficient use of money, resulting in potentially far greater accumulation than just paying cash or using someone else’s money. Key to the process is minimization of transfers and accessibility of a safe pool of money.

Future Effect of Paying Cash

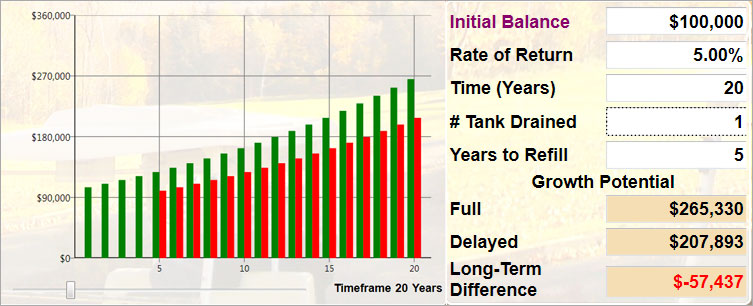

Many people believe that paying cash for personal or business needs is the most cost effective method because unlike borrowing, no interest is paid. Interest is, however, given up. Look at the chart below to see the future effect of paying cash vs. keeping money invested.et

The problem with draining your reserve for a purchase is that it “resets” the compounding cycle, or “shifts” the beginning earnings column (red) to the “right” (or 5 years later in this example), resulting in less cash available (-$57,437 in year 20 for this example).

PRS

As an alternative to paying cash, PRS is a method that allows your money to remain invested even while it is being leveraged for personal or business needs.

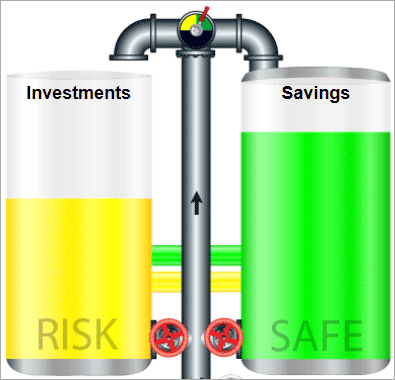

The above diagram shows the basic flow of money in PRS, with money for purchases (education, car, wedding, etc.) being supplied by the financial instituion that holds the Private Reserve. The financial institution places a lien on the reserve to secure the loan, and the user of the money (you, someone else, or your business) repays the loan which, over time, pays off the lien. The lien also allows the reserve to continue earning interest and dividends, helping to offset the cost of the loan.

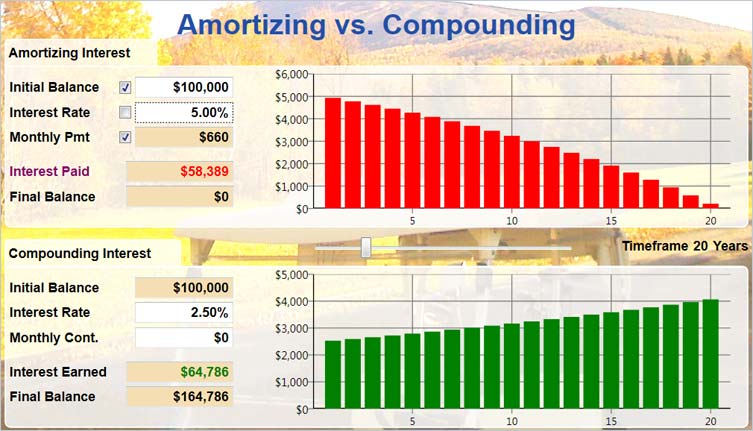

Why does this result in more money to you over time? It is because of the difference between an amortizing loan and compounding interest, as graphically shown below.

In the chart above, note that the interest rate being paid for the loan (5%) is double the interest rate (2.5%) being earned on the compounding balance and, yet, the interest earned ($64,786) is still more than the interest paid ($58,389). In addition, the principle ($100,000) is still available in the compounding interest scenario.

Why is this possible? Because amortizing interest is paid on a decreasing balance while compounding interest is earned on an increasing balance.

Because of this understanding, we believe that a properly structured and utilized Private Reserve is an extremely powerful addition to your financial position. If you want to see PRS examples with your numbers and how to most effectively set up PRS for you and/or your business, contact us today.