The question: will I have enough for retirement?

The question: will I have enough for retirement?

The answer: build a comprehensive model of your present position and then model changes and compare them to your baseline.

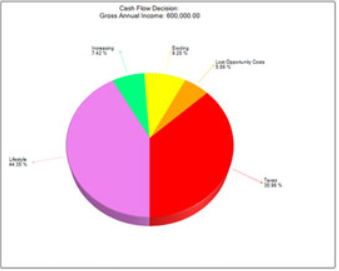

We believe in full disclosure. That is why we build a comprehensive model of your finances right in front of you. It’s also why we calculate historical inflation and rates of return, taxes and even opportunity costs.

Then, we identify your transfer dollars and model solution options for you. Each plan is therefore unique and shows you what you need to know to make an informed decision.

This is the equivalent of working on your financial swing rather than just choosing the most popular financial club, hoping that will win your retirement game for you. We don’t care about what you make as much as we care about what you get to keep.

Can I pay for college without jeopardizing my retirement?

Paying for college is likely to be the single largest expense in your family’s lifetime. That is why you have the potential for transferring a great amount of wealth if you do so inefficiently.

We believe in creating a comprehensive college funding solution that shows you how paying for college will affect all areas of your financial life, and identifies sources of funding (whether your child receives financial aid or not), to ultimately impact your overall plan as little as possible.

If you could cut your out of pocket education expense by half and still have your child attend their 1st choice school, would that be worth creating a plan?

If you could pay the entire cost of college by finding transfer dollars equal to the whole cost of college, would that be worth creating a plan?

To begin y our plan, here are some things you’ll need to know – or work with someone at Larry E Wallace Financial who does:

our plan, here are some things you’ll need to know – or work with someone at Larry E Wallace Financial who does:

My family’s category (1, 2 or 3)

Expected family contribution

Sticker price

Out of pocket price

Institutional methodology

Federal methodology

FAFSA

CSS Profile

Asset allowance

Base year

Award history

Gift vs. self help aid

Often, your single largest asset is your house. Consequently, if you’re not careful, you may transfer more wealth in the way you finance your house than with any other area of your finances.

You will finance your house, whether you take a mortgage or pay cash. The question is, “What’s the safest and most cost effective way to finance?”

We are not a mortgage financing company or mortgage broker, but we will examine your options with you to put you in control of your equity rather than the bank, to make sure you are earning all you can rather than the bank.

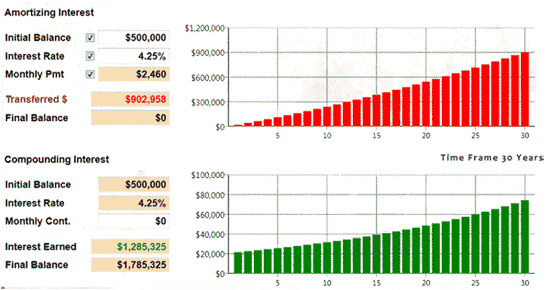

What does the chart below suggest as it relates to your financing options?

The chart above shows both an amortizing balance of $500,000 and a compounding interest balance, also of $500,000, with the same interest rate of 4.25%. Over a 30 year time frame, the Transferred $ (or interest paid at opportunity cost, interest at interest) total of $902,958 is significantly less than the interest earned total, $1,285,325.

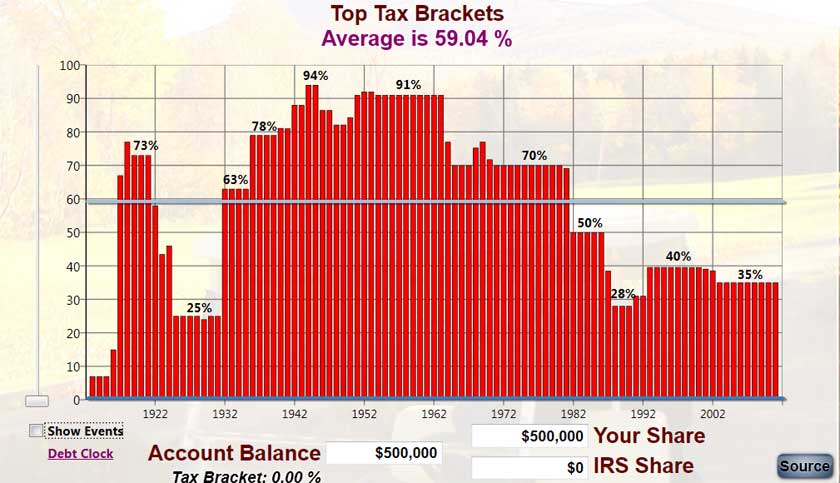

Which way to you think taxes are headed? Up, down, or staying the same?

Either way, the real question is, ” How much tax risk am I willing to take?”

Examine this chart of the historical top Federal income tax rates in the U.S. since 1913, the beginning of income taxes.

Now answer the question again, “How much tax risk am I willing to take?”

We believe in full disclosure: know your tax risk. Then, reduce your tax risk to gain control of your assets and make them last as long as you’ll need them.

Who would you rather have in control of your money: Uncle Sam or yourself? We think the choice is obvious yet too often overlooked. Are you ready to reconsider your long term tax risk?

Do qualified plans (including 401k, 403b, SIMPLE, SEP, IRA plans) save taxes?

Actually, qualified plans do two things:

|

Many people are under the impression that contributing to a qualified plan necessarily saves taxes. Actually, “postpone” may be a more accurate term. You will pay the tax. The question is, “At what rate?”

|